We Tested ChatGPT's Deep Research Tool: Here's What Comms Professionals Need to Know

We put ChatGPT's new Deep Research feature through its paces with a real comms challenge. The results? Not perfect, but more than strong enough to prove its worth in certain situations.

ChatGPT's Deep Research tool launched in February with a bold promise: AI that can "basically do all your research for you." For communications professionals drowning in competitive intelligence, crisis monitoring, and endless stakeholder mapping, this sounds like either salvation or snake oil.

We decided to find out which.

What Deep Research Actually Does

Think of Deep Research as hiring an inexhaustible research assistant who works for several hours straight, systematically browsing hundreds of sources to create comprehensive, cited reports. Unlike ChatGPT's regular search function, which gives you quick answers in seconds, Deep Research deliberately takes time to deliver thorough, documented analysis.

The tool uses OpenAI's o3 reasoning model to conduct multi-step research projects, analysing and synthesising information from diverse online sources. Every output comes fully documented with clear citations – crucial for maintaining professional credibility in comms work.

The results themselves adhere closely to the type of research and analysis reports that agencies spend days or weeks preparing for clients, charging accordingly. So how does it compare?

Current availability (full pricing here):

- Free users: 5 lightweight queries per month (“Lightweight” = more cost-efficient model based on o4‑mini)

- Plus subscribers (£20/month in the UK): 10 full searches + 125 lightweight queries per month

- Pro subscribers (£200/month in the UK): 125 full Deep Research queries per month (plus also 125 lightweight queries per month)

The Comms Professional's Reality Check

What does this actually mean for day-to-day work?

Where it could genuinely help:

- Competitive intelligence gathering

- Crisis background research

- Industry trend analysis

- Stakeholder sentiment mapping

- Client briefing preparation

Where you'll still need human judgement:

- Verifying claims and sources (you’ll need to review first before sharing!)

- Understanding context and nuance

- Strategic interpretation

- Relationship-based insights

To its credit, OpenAI is transparent about limitations: Deep Research can sometimes hallucinate facts, struggle to distinguish authoritative information from rumours, and often fails to convey uncertainty accurately.

Our Test: Deep Researching Ourselves

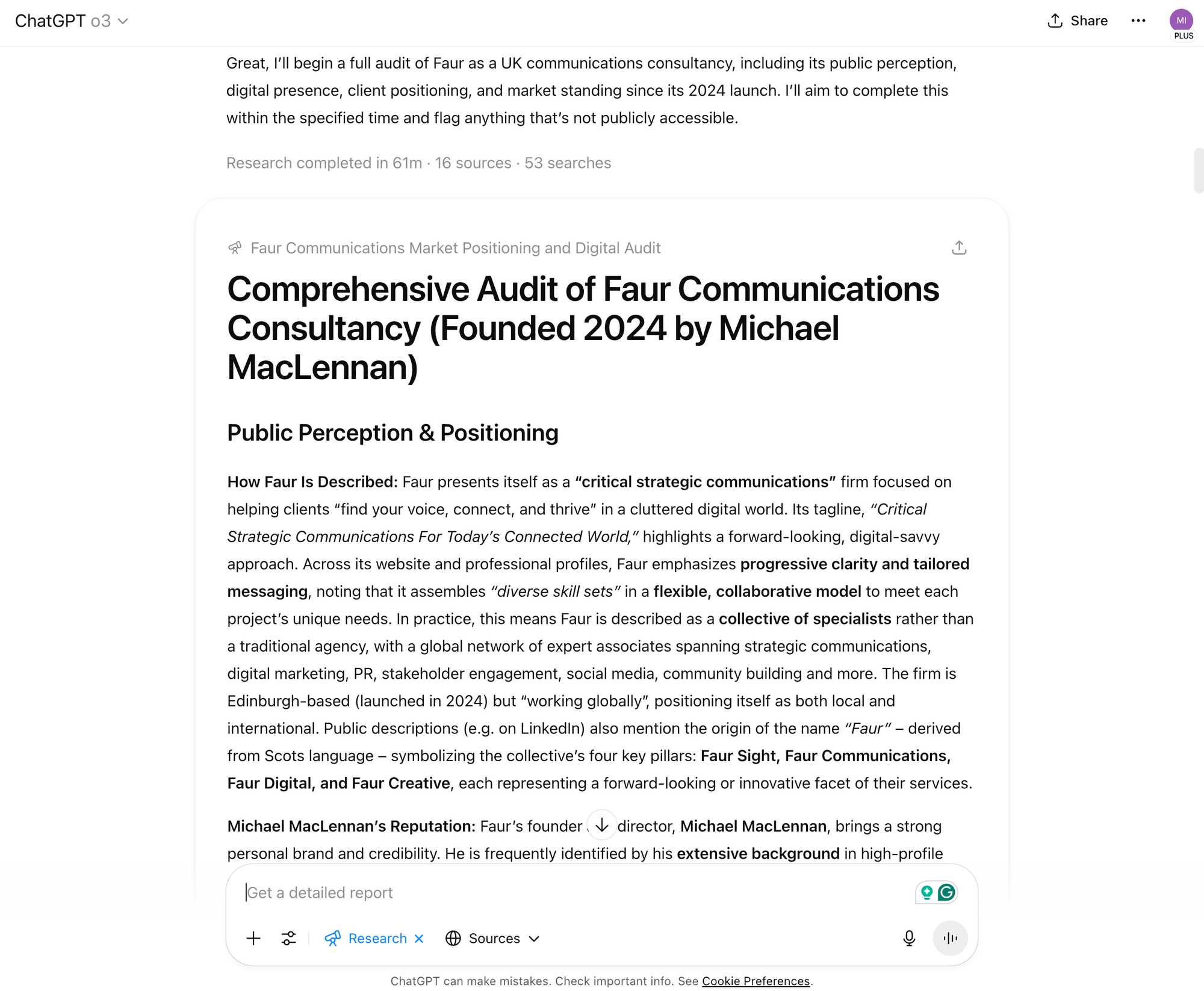

To properly test this tool for Applied Comms AI, we decided to turn the lens on ourselves. We asked Deep Research to conduct a comprehensive audit of our own organisation, Faur: analysing public perception, competitive positioning, digital presence, and identifying opportunities and gaps.

Here's the prompt we used. We undertook several revisions to ensure that it is helpful in providing both a purpose and overall structure useful for organisational analysis/peer review (please feel free to copy, paste, and amend for your own use):

"I'm testing Deep Research for a newsletter about AI in communications.

Please conduct a comprehensive analysis of 'Faur' - a UK communications

consultancy founded in 2024 by Michael MacLennan. Research:

PUBLIC PERCEPTION & POSITIONING:

- How Faur is described across websites, press coverage, and networks

- The founder's professional reputation and thought leadership

- Stated expertise areas and service offerings

- Client work mentioned publicly

COMPETITIVE LANDSCAPE:

- Positioning vs other UK communications consultancies

- Unique selling propositions compared to traditional agencies

- The 'collective' model vs conventional structures

DIGITAL PRESENCE:

- Website effectiveness and messaging clarity

- Social media presence and engagement

- Content strategy and thought leadership output

OPPORTUNITIES & GAPS:

- Areas where competitors are stronger

- Underutilised positioning opportunities

- Potential reputation risks or weaknesses

Please provide specific examples, URLs, and dates where possible."

The Process: What Actually Happens

When you select "Run Deep Research" from the Tools menu, ChatGPT typically asks clarifying questions before starting. In our case, it asked three smart follow-up questions:

- Competitor comparisons: Did we want named competitors analysed, or general market positioning?

- Geographic scope: UK-focused or international sources?

- Digital presence priorities: Specific platforms or general overview?

This clarification step is a helpful prompt in itself – it forces you to think through research boundaries and potential sensitivities. We opted for general positioning (since this was going public), UK focus, and broad digital analysis.

Once it begins, real-time progress is shown through the Activity panel on the right. You can watch in real-time as it:

- Identifies research angles and sub-questions

- Searches across different types of sources

- Builds up a comprehensive source list

- Synthesises findings into structured insights

The AI confirmed our parameters: "I'll focus on how Faur and its founder, Michael MacLennan, are discussed online, their market stance, and visible strengths or gaps" before diving into the research.

Time investment: Our first attempt unexpectedly got stuck on a hard-to-access source (see below). After giving it some time, we stopped and undertook a second attempt – this time with clearer boundaries around time limits, since even AI research assistants can clearly get lost down rabbit holes… If you account for refining the prompt, then going away while it was doing its thing, the process probably took 10-15 minutes of time.

Source quality: The tool pulled from a mix of professional networks, industry publications, company websites, and news sources. Impressively, it found several mentions we weren't aware of, although it also missed some obvious sources.

What We Actually Discovered

The unexpected challenge: Our first research attempt got stuck trying to access a Facebook post about a speaking engagement. After the best part of a day of the AI trying to access restricted content, we had to restart with clearer instructions: "skip anything after a reasonable time period if too difficult to access."

This reveals something important: Deep Research can get overly persistent with inaccessible sources, burning through your allocated time. Always include time boundaries in your prompts, so it can be ready for you closer to when you’re after it.

The surprisingly comprehensive: Within the space of 61 minutes (it allows you to go away and let’s you know when finished), Deep Research had conducted 53 searches, referred to 16 sources, and produced a 10-page, 5900-word audit covering everything from competitive positioning to SEO analysis.

Delving into details including client testimonials, speaking engagements, and my own ScotlandIS board appointment, the structured approach (Public Perception, Competitive Landscape, Digital Presence, Industry Standing, Opportunities & Gaps) was methodical and thorough.

The useful insights:

- Positioning clarity: Identified that our "collective model" differentiator could be explained more clearly to potential clients

- Content gaps: Spotted that we have only one detailed case study publicly available despite working with multiple high-profile clients

- SEO opportunities: Noted our unique name "Faur" helps with branded searches, but we're missing generic search traffic

- Competitive angles: Highlighted how our AI-focused content positions us differently from traditional agencies

The concerning accuracy issues:

- Some details were outdated or slightly wrong (mixing up dates, over-stating follower counts)

- Occasional misattribution of achievements or quotes

- Limited understanding of UK market context and Scottish business landscape – the level of knowledge in terms of the competitive analysis felt a bit too surface-level compared to what a sector expert would lay out

- As a similar note, missed nuanced relationship knowledge that comes from actually being in the industry

The strategic recommendations:

- Suggested emphasising "Scotland base with global reach" as a differentiator from London agencies

- Recommended more explicit positioning as an "AI-informed communications consultancy"

- Identified potential reputation risk of being too founder-dependent

- Proposed specific content strategies like featuring client logos (with permission) on the homepage

- These recommendations felt valid, if already fairly evident – there’s nothing there that I hadn’t personally thought of prior to now (with various dull reasons – generally relating to lack of time – as to why I haven’t acted on them)

Practical Prompting Tips for Using ‘Deep Research’ for Comms

Based on our testing, here's what works:

Be specific about scope: "Analyse reputation over the last 12 months" works better than "research our reputation". If feeling unclear on what you’re after, you can even ask ChatGPT to help you shape a more specific and useful scope, prior to conducing the Deep Research

Structure your request: Break complex research into clear categories (perception, competition, opportunities)

Request examples: Always ask for "specific examples, URLs, and dates where possible"

Set context: Explain why you're researching and how you'll use the findings

Think through sensitivities: Consider what you're comfortable making public if this research gets shared

Set time boundaries: Include phrases like "skip sources that take longer than reasonable time to access" to prevent getting stuck

Expect clarifying questions: The AI will likely ask 2-3 follow-ups to refine scope – this is helpful, not annoying

Plan verification: Build in time to cross-check key claims and sources – the initial results should certainly not be considered client- or stakeholder-ready. Human oversight is still all important

When to Use Deep Research (And When Not To)

Perfect for:

- Quickly assembled competitive audits to kick off project work

- Client sector research and briefing prep (picking up details that go beyond typical searching)

- Crisis background research requiring multiple sources

- Industry trend analysis across publications

- Stakeholder sentiment mapping

Skip it for:

- Quick fact-checking (regular search is faster)

- Relationship-based intelligence (it can't read the room)

- Real-time crisis monitoring (it can take hours to deliver, and relies more on historical information)

- Highly technical or niche industry research

- Information requiring insider knowledge

The Verdict: Impressively Thorough, Strategically Valuable, Though Not as ‘Deep’ as Claimed – Yet

Deep Research delivered something truly useful: a comprehensive external perspective on our own business that would have taken days to compile manually, and that we simply wouldn’t have the resource to manually produce. The 10-page audit covered positioning, competitive landscape, digital presence, and strategic opportunities with a level of systematic thoroughness we could never have achieved in the same timeframe.

What impressed us: The AI identified our unique positioning elements (the collective model, Scottish base with global reach, AI-forward approach) and articulated them clearly. It spotted content gaps, SEO opportunities, and competitive differentiators, and packaged them up neatly before providing actionable next steps.

Where human oversight proved crucial: While comprehensive, the research contained some minor factual errors, outdated information, and missed contextual nuances that come from actually working in the UK communications market. Some insights were spot-on; others would need correction before presenting to others.

The strategic value: Despite accuracy issues, the external perspective revealed blind spots and articulated opportunities we hadn't considered. The recommendation to position more explicitly as an "AI-informed communications consultancy" was particularly helpful – it's something we'd been doing but not saying clearly enough.

For Applied Comms AI purposes, this demonstrates Deep Research's sweet spot: comprehensive initial research and strategic thinking acceleration, with essential human verification and context-setting.

Your Turn: Deep Research Prompts to Try

If you're ready to experiment, here are three comms-focused prompts worth testing:

Crisis Preparedness Audit:

"Research potential reputation risks for [Your Organisation/Client] including:

recent industry controversies, common criticism themes, regulatory issues,

and emerging challenges that could impact reputation in the next 12 months."

Competitive Intelligence Deep Dive:

"Analyse [Organisation]'s competitive positioning vs [3-5 competitors].

Focus on: messaging strategies, share of voice, thought leadership content,

and opportunities for differentiation."

Stakeholder Sentiment Mapping:

"Research stakeholder perceptions of [Organisation] across: employee

sentiment, customer feedback, media relationships, and industry peer

recognition. Identify recurring themes and improvement areas."

The Bottom Line

Deep Research isn’t ready to replace strategic communications expertise – yet – but it can significantly accelerate the research phase of our work. At £20/month for 10 full searches, it's massive level of value given the many hours of extra time it would take even for a single search.

Just remember: trust, but verify. And always apply the strategic context that comes from actually understanding the communications landscape.

Have you tested Deep Research for comms work? Hit reply and share your experiments – we might feature insights in a future edition.